Hidden Landmines in Acquisitions: SME Financial Due Diligence

- Alexander Kalis

- Jun 9, 2025

- 1 min read

The most dangerous problems in SME deals aren’t in the pitch, they’re in the books.

In this post, we unpack the most overlooked financial red flags in SME financial due diligence that derail buyers post-close:

Revenue concentration and phantom contracts

Working capital manipulation before closing

CapEx deferrals and accounting games

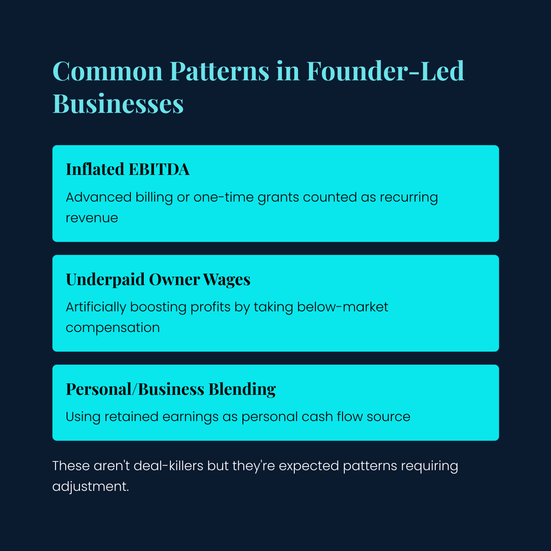

EBITDA add-backs that don’t stand up in due diligence

Even experienced investors can get caught if they don’t know where to look.

Swipe through or download the PDF for offline reading.

At Archimax, has combined insights from leading M&A practitioners to help you build a smarter checklist and avoid these traps.

Sources: PwC, MarktoMarket, UK200Group, PitchBook, DueDilio, and Archimax Research

Comments