How Private SME Lending is Transforming Business Succession in Europe

- Alexander Kalis

- Jun 5, 2025

- 1 min read

With traditional banks pulling back, private capital is stepping in and unlocking new paths for succession.

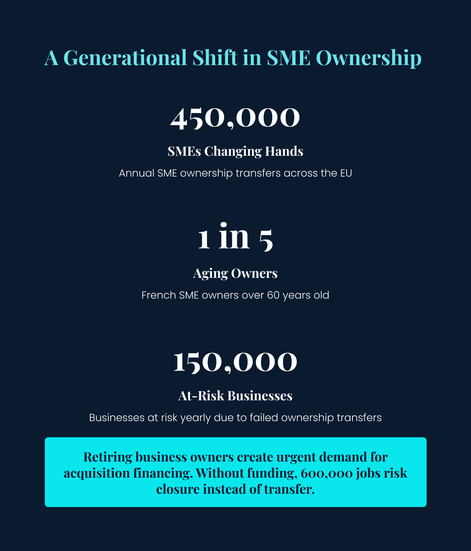

Across Europe, a generational shift is underway:

450,000 SMEs change hands each year

1 in 5 French SME owners is over 60

150,000 businesses are at risk annually due to failed transitions

This 8-slide breakdown explores how private SME lending is enabling a new wave of acquisition entrepreneurs and reshaping the future of small business ownership across the UK, Benelux, France, and beyond.

Instead of relying on rigid bank loans, today’s buyers are closing deals using more flexible and creative capital structures, including:

Acquisition loans

Revenue-based financing

Preferred equity and mezzanine solutions

Swipe through or download the PDF for offline reading to see the capital reshaping the market—and how we’re planning to support the next generation of buyers.

Brought to you by Archimax

We acquire businesses and support SME buyers with advisory and platform-based services across the UK and Europe.

We are currently exploring plans to offer structured financing solutions, including acquisition loans, to selected corporate borrowers.

If you’re planning to acquire a business or set up a holding company and want to learn more, feel free to get in touch for an informal, no-obligation conversation.

Sources:

British Business Bank, Bpifrance, European Investment Fund, IESE Search Fund Reports, European Commission, Deloitte, Allied Market Research, and Archimax Research

Disclaimer:

Archimax Private Lending Ltd is not yet incorporated and does not currently provide financing. This content is for informational purposes only and does not constitute a financial promotion, investment advice, or offer to the public. It is intended solely for business owners, professional clients, and high-net-worth individuals.

Comments